Contact Us

Meet Our Team

Daryl

Kevin

Portfolio

Latest News

Red Ocean Investing Process

Red Ocean Investing Process

Have you ever felt like your investments were getting lost in a big, red ocean of competition? You’re not alone. Fortunately, there are ways that you can stand out and make waves with the right red ocean process. In this blog we aim to show you the perfect process to stay ahead in the competition with investing. So buckle up and let’s get started!

Introduction to Red Ocean Investing Process

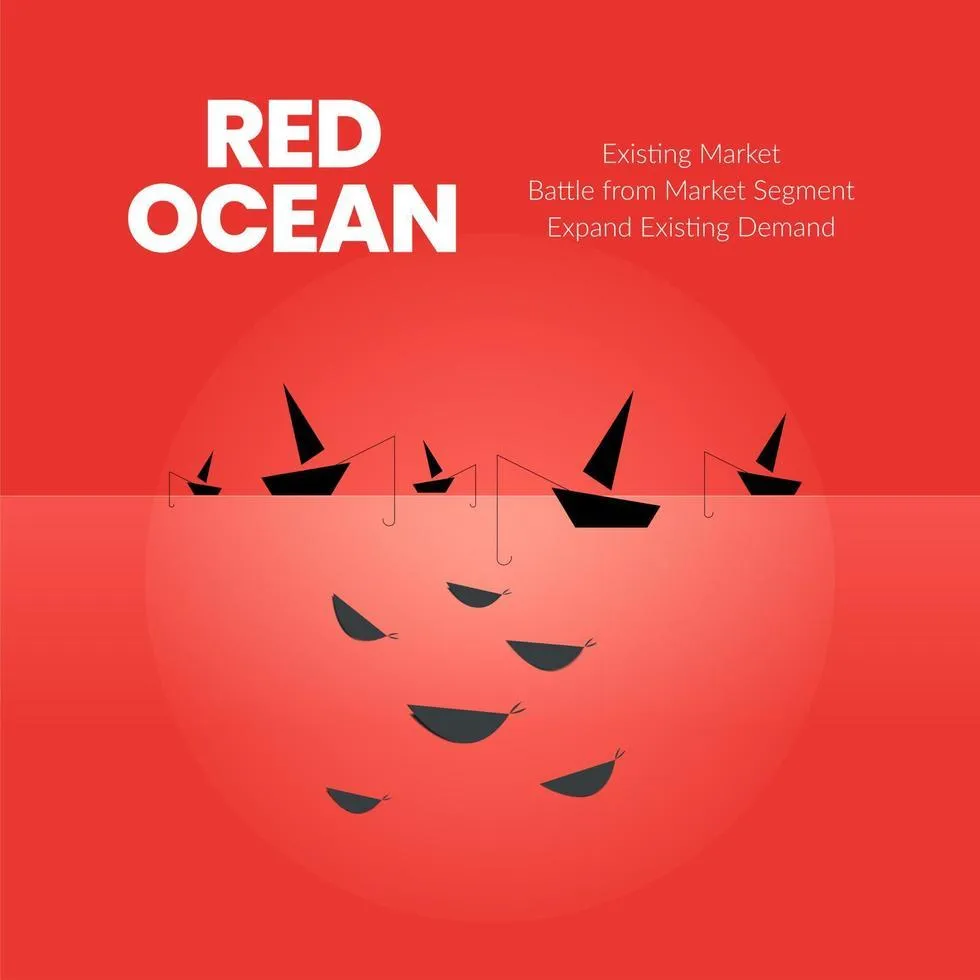

The term “red ocean” refers to the competitive landscape of today’s economy, where different companies try to outdo each other in order to gain a competitive edge and satisfy their customers. Investing in red ocean processes involves analyzing the competition, understanding customer needs, and acting proactively based on those needs. By investing in red ocean processes, investors can gain a better understanding of their investments and how they can be better managed for economic success.

Red ocean investing focuses on exploiting existing markets rather than creating new ones. It is based on the concept of "creative destruction," which suggests that by taking part in the competition and using new technologies, businesses can develop new markets and keep competition alive. Through creative destruction, businesses are able to create sustainable value that can carry them into new industries and markets over time.

Investors should understand how their strategies evolve as market conditions change over time. Competition should be continually monitored so that effective strategic decisions can be made when needed. For example, if an industry is becoming saturated with similar products or services, then investors may need to look for other opportunities or shift their focus away from the existing market(s). They may also need to adjust their strategies based on what customers are looking for—such as convenience or certain features—so that the overall investment strategy remains profitable over time.

Understanding the Red Ocean Strategy

The red ocean strategy is a concept popularized by Harvard Business School professor, Renée Mauborgne, in her book Blue Ocean Strategy. The strategy is based on the idea that a company's business environment can be characterized as either a red ocean or a blue ocean. A red ocean represents an overly competitive market where many established companies are selling similar products to the same set of customers. Competition results in shrinking profits, marginal growth, and little differentiation between companies. In contrast, a blue ocean offers new opportunities for growth with less competition and more uniqueness among companies operating in that space.

Investing using the Red Ocean Strategy involves assessing and analyzing existing industry trends and then making investments based on those trends’ potential for success. Companies using this strategy often focus on one aspect of their product or service and become highly specialized in order to remain competitive and profitable. For example, if there is an established market for distributed ledger technology (DLT) solutions, investors may decide to focus on investing in one type of DLT solution like blockchain-based storage services instead of investing in many DLT solutions across multiple industries at once. Other important considerations include overall market size, customer needs/wants, positioning versus competitors, regulatory factors (especially when dealing with innovative products), resources to launch/operate products and services, as well as potential financial returns (in terms of both cash flows/returns and public awareness/branding).

Benefits of Investing in a Red Ocean Process

When it comes to investing, there are often two ways of looking at things: the “traditional” or “blue ocean” approach, and the newer “red ocean” approach. The blue ocean strategy focuses on seeking out untapped markets and emerging opportunities, while the red ocean approach looks for existing markets with potential for growth and established infrastructure. Investing in a red ocean process can have significant benefits for investors.

First, by investing in an existing market or process, investors have the advantage of taking advantage of an established population of customers or companies that will likely be more open to participating in their projects. This means less time spent marketing and more investments going towards scaling up or increasing your product or process. Second, by investing in an existing market, investors also benefit from being able to take advantage of existing infrastructure that can be leveraged for creating a larger customer base faster.

Furthermore, by investing in a red ocean process you can access large data sets which allow better insights into patterns and trends so you can make better overall decisions when it comes to investing strategies. Additionally, by working within a mature market you can use primary research such as surveys to understand customer preferences much more quickly than if they were starting from scratch in an untapped market.

Finally, because these existing processes are well-understood and documented it is also easier to create financing strategies that aligns with investor objectives while reducing risk associated with starting something new from scratch. In addition to these many benefits associated with working within existing markets and processes there are plenty of opportunities for those willing to take on new challenges that may exist when diving deep into unknown waters!

Challenges of Investing in a Red Ocean Process

Investing in a red ocean process, also known as a "race to the bottom," can be difficult and risky. With an increasing number of similar businesses competing with each other for market share, companies must challenge themselves not just to meet but exceed customer expectations. The risk involved in investing in a red ocean market can be compared to gambling: with greater opportunities come greater risks, which may lead to less predictable outcomes.

Although investing in a red ocean has its advantages, certain challenges must be considered before entering into such an arena. One of the primary challenges is the abundance of competition, which can make it difficult to differentiate products and services from those of competitors. Moreover, as shoppers tend to compare prices and services from multiple providers before making their decision, prices may have to be lowered frequently in order for businesses to stay competitive. Further complicating matters is the unpredictability of consumer satisfaction ratings and reviews; increasing competition may lead to decreased customer loyalty and consequently negative ratings that could drive potential customers away from your business.

In addition, investing heavily in existing markets carries additional risks such as political instability or changes in consumer preferences that could dramatically affect profits or even lead to losses for the company. Furthermore this approach often leads companies away from researching new markets or trying out different business models; this could mean that opportunities are being overlooked by focusing on maintaining profitability within existing markets alone. Lastly, considering the amount of money needed upfront when competing with huge corporations often proves difficult financing issue for smaller businesses

Different Types of Investments in a Red Ocean Process

Before you enter into a red ocean process with investing, it is important to understand the different types of investments available to you. These investment options can be divided into two broad categories - traditional investments and alternative investments.

Traditional investments include stocks, bonds, and other equivalent instruments listed on global markets. Stocks are equity ownership in a company and represent the percentage that an investor will receive from the profits of the company. Bonds are debt instruments issued by companies or governments to borrow money from investors for a predetermined period of time at fixed interest rates.

Alternative investments are non-traditional investments not listed on public markets. These can include venture capital, private equity, real estate, start-ups, cryptocurrency, hedge funds and others. Venture capital is when a company or individual invests money in an early stage or high potential business in exchange for ownership stakes or potential profits generated through the business long-term performance. Private equity is when private ownership interests are bought out of publicly traded companies in order to get shares in those businesses that may not be available to regular investors. Real estate includes buying up residential and commercial properties as investments over time with the expectation of increasing income through rent or asset appreciation over time. Start-ups refer to very early stage businesses where venture capitalists invest their own capital into these businesses for marketable assets like shares held by investors for future stake sale prospects or option returns at maturity once certain goals have been met by the business itself. Cryptocurrency refers to digital assets whose value is ‘mined’ from mathematical calculations on servers around the world as well as used for trading between buyers/sellers such as Bitcoin, Ethereum, Ripple and more recently NFTs (non-fungible tokens). Hedge funds refer to pooled investor money managed by professional fund managers where they strive to generate returns through creative strategies such as leverage buyouts (LBOs) and arbitrage opportunities across different markets in line with well defined investment mandates that generate alpha through intensive research efforts along with consensus building across different portfolios managed within the fund itself.

These options have become increasingly popular due to higher expected returns than traditional retail banking products such as savings accounts or certificates of deposit (CDs). Before entering either realm of investment however one needs to properly analyze financial indicators including risk appetite among many other factors tailored more specifically towards individual level goals - mental models constructed by seeking advice from experienced finance professionals equipped pertinent knowledge about these industries before taking any decisions about investing your hard earned money whichever way it may be!</p><h2>Analyzing the Risk and Return of a Red Ocean Process Investment</h2><p>

When considering a red ocean process to invest in, it is important to understand both the risk and return associated with that investment. The level of risk associated with any investment depends on the underlying opportunities and potential for return of those opportunities. When evaluating a red ocean process, the investor should assess its current profitability, potential profitability over time and what actions need to be taken to realize these returns.

The investor should also consider the degree of competition in the red ocean process and whether there are barriers to entry that could limit their degree of success. Additionally, they should also analyze how quickly they could recoup their initial capital outlay as well as if there are any exit strategies available that would allow them to recover their capital if something were to go wrong with the investment.

Finally, it is important to compare different red ocean process investments against each other in order to identify which one has the highest potential for a positive return on investment (ROI). This comparison can be done using financial models or simulated scenarios where different levels of risk and return are compared against one another. In this way, an investor is not only able to determine what type of returns can be expected from investing in a red ocean process but also choose which investments have the highest chance for success.

Strategies to Maximize Returns in a Red Ocean Process

When investors move towards a red ocean strategy, it is important to understand that this can be an incredibly competitive field. This type of venture capital investing involves looking for deals in the most saturated markets and attempting to create value by taking advantage of those opportunities or by providing services or products that go beyond what is available from industry competitors. To maximize returns, there are several strategies investors can use when adopted within a red ocean process.

First, investors need to use their evaluation skills to identify the right companies and products to target with their investment. This includes taking into account factors such as market positioning and size, customer needs and preferences, pricing, innovation potential, and business strategy. Once potential investments have been identified, investors should also focus on building trust with key partners in the industry before making any commitments or putting money into a venture.

In addition to scanning the market for deals, it can be beneficial for investors to leverage the power of networking in order to establish connections with the right people in the industry. Participating in events such as conferences and other informal gatherings can open up additional opportunities for discovering new startups or companies that could benefit from investment capital. By engaging in meaningful conversations about trends in the industry and keeping up-to-date on emerging technologies, investors are likely to remain abreast of interesting initiatives that may lead directly or indirectly towards profitable investments.

Upfront research is essential if one wants to achieve success while venturing into a red ocean process; however given its highly competitive nature one must also stay aware of changing trends and developments which could significantly affect how successful one's investments end up being. It is important during these times to quickly evaluate situations related to investments or even hypothetically assess potential investments related risks before making any decisions as mistakes made at this stage could be disastrous later on down the line when profitability considerations exist

Conclusion on Red Ocean Process with Investing

The red ocean process with investing can be a great tool to use to easily navigate through the financial market. By taking into account key data points, investors can make informed decisions that have potential to provide successful returns and minimize their risk. The process helps investors focus on market innovation, technology, and customer trends that are specific to their portfolio objectives. Additionally, it allows investors to allocate capital in an organized and targeted way.

However, the red ocean process may not be suitable for investors with a very limited understanding of the markets or financial plans that contain non-traditional components. If a more comprehensive approach is needed, investors should consult a professional financial advisor for guidance as they navigate through their investments. Ultimately, one should use the red ocean process with investing as part of an overall strategy for creating lasting value for their financial future.

Contact for Information or Deal Presentation

TFMS relies on the vast knowledge it has gained by operating more than 500 Units in 49 states, which together account for more than $300 million for TFMS Holding Group and Companies. The TFMS Holding Group specializes in fair and meticulous negotiating with an ever-increasing range of repeat vendors and representatives.

Headquarters

2901 Butterfield Road

Oak Brook, IL 60523

630.218.4948

Connect With Us

Useful Links

Home

Privacy Policy

Terms and Conditions

Copyright © 2022 TFMS Holdings